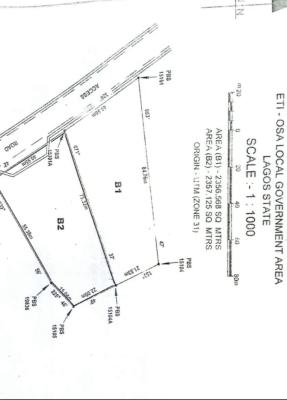

Joint Venture Land in Ikoyi, Lagos

Quick Filters

Subtypes Localities Areas Sub Areas

20

How many land joint venture in Ikoyi, Lagos are available?

There are 67 available land joint venture in Ikoyi, Lagos.

You can view and filter the list of property by price, furnishing and recency.