9 Bedroom Property for Sale in Estates, Lagos

Quick Filters

Types Sub Areas

- Airport Road|

- Amity Estate|

- Baruwa Estate|

- Beachwood Estate|

- Beckley Estate|

- Choice Estate|

- Citiview Estate|

- Cooperative Estate|

- Cornerstone Estate|

- Destiny Homes Estate|

- Divine Estate|

- Eko Akete Estate|

- Eleko Beach|

- Estates|

- FAAN Estate|

- Fidiso Estate|

- Genesis Estate|

- Gracias Emerald Estate|

- Greenfield Estate|

- Heritage Estate|

- Ikorodu Road|

- Iroko Estate|

- Jonathan Estate|

- Jubilee Estate|

- Lekki Epe International Airport|

- Maplewood Estate|

- Maruwa Estate|

- Novare Mall|

- Opic Estate|

- Otedola Estate|

- Rufus Laniyan Estate|

- Santos Valley Estate|

- Shagari Estate|

- Sparklight Estate|

- Yaba College of Technology

21

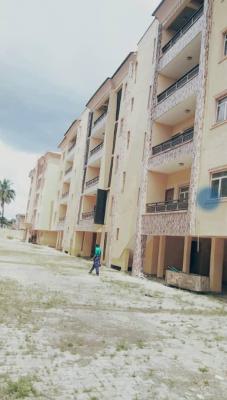

12 bedroom block of flats for sale

Adewale Adegun Street Karaole Estate Off College Road, Ogba, Ikeja, Lagos ₦250,000,000188 bedroom hotel / guest house for sale

Murtala Mohammed International Airport, Ajao Estate, Mafoluku, Oshodi, Lagos ₦8,500,000,00012 bedroom block of flats for sale

2 Olufunke Abeke Close, Greenville Estate, Badore, Ajah, Lagos ₦150,000,00060 bedroom house for sale

Off Monestary Road Behaving Novare Mall, Sangotedo, Ajah, Lagos ₦2,500,000,00021 bedroom detached duplex for sale

8, Kudeti Street, Off Abah Johnson, Akora Estate, Via Zenith Bank, Adeniyi Jones, Ikeja, Lagos ₦850,000,00032 bedroom block of flats for sale

Ajao Estate Off International Airport Road, Isolo, Lagos ₦1,800,000,000How many 9 bedroom flats, houses, land and commercial property for sale in Estates, Lagos are available?

There are 360 available 9 bedroom flats, houses, land and commercial property for sale in Estates, Lagos.

You can view and filter the list of property by price, furnishing and recency.